Sorry payroll service providers, you’ve gone out of style. Nowadays, a do-it-yourself payroll management approach with the help of payroll software is the way to go. Payroll systems are often less expensive, more flexible and more accessible to modify than traditional payroll services.

If your business hasn’t adopted a payroll system yet, in the words of John Cena, “The time is now.” We’re here to help ensure you don’t settle for just any payroll provider by breaking down must-have payroll software features and popular vendors.

Compare Top Payroll Software Leaders

Article Roadmap:

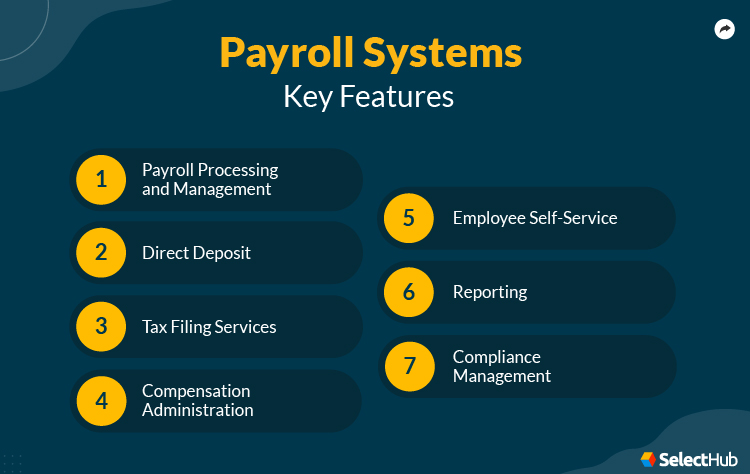

Key Features

When shopping around for payroll software vendors, keep your eyes peeled for the most essential payroll software features.

Payroll Processing and Management

The most crucial function of any payroll system is to process and manage payroll, providing the foundation for all other payroll features.

Payroll processing and management streamline the complex task of paying employees accurately and on time. It is indispensable in maintaining employee satisfaction, legal compliance and financial transparency.

It ensures compliance with tax regulations and labor laws, automates the calculation of salaries, deductions and tax withholdings while providing electronic payment options and generates reports for audits.

Namely Payroll Management Preview.

Direct Deposit

After all, a payroll system’s whole point is to ensure your employees get paid. The days of handing out checks at the end of the week are all but gone.

Direct deposit is a win-win for businesses and their employees. Businesses save and time by avoiding printing and distributing paychecks. At the same time, employees don’t have to worry about losing their checks or experiencing check fraud (while also helping the environment by saving paper).

Zenefits Payroll Schedule Preview.

Tax Filing Services

Properly filing your taxes is a big deal — just ask Shakira. That’s why the best payroll systems provide tax filing features. Like any manual calculation, calculating tax takes time and has the potential for mistakes. To avoid any miscalculations or issues with federal, state, local, Social Security and other payroll taxes, it’s best to let the software handle it.

The same goes for tax documents like W-2s and 1099s. A good payroll system should be able to automatically generate tax documents, fill in the deposit information and send those forms to the right agency. This feature streamlines the tax filing process from beginning to end with minimal oversight.

Tax Filing Services. Source

Compare Top Payroll Software Leaders

Compensation Administration

Managing compensation goes beyond standard payroll and wage management, accounting for non-traditional pay methods. Worker’s compensation, bonuses and adjustments for changes in minimum wage, cost of living and other factors are all handled by compensation management features. This functionality oversees non-traditional payment practices, providing an extra layer to your overall payroll management strategy.

Oracle HCM compensation management features.

Employee Self-Service

Insperity sums up just how beneficial employee self-service capabilities are for payroll systems. They explain that employee self-service “puts all of your employees’ personal payroll data at their fingertips so they have easy access to their pay stubs, W-2 forms and paid time off balance.”

In other words, your employees don’t have to take time away from your human resources department by requesting access to their information. With self-service features, employees quickly get their necessary payroll data and forms whenever needed without waiting around or taking time away from their HR department.

Payroll Dashboard Employee Self Service.

Reporting

Most business software categories must include some form of business intelligence or reporting feature. As you can imagine, payroll solutions are no exception because reporting gives insights into your payroll processes.

Payroll reports provide a high-level overview of your budget, taxes, workers’ compensation and other payroll data. These reports reveal trends and patterns that HR and accounting departments use to improve their operations, like detecting productivity bottlenecks. Whether it’s allocating resources better or managing overtime differently, these insights can lead to cost savings and more efficient payroll processing.

A BizRun payroll report.

Compliance Management

When managing financial matters, compliance is necessary. Just like traffic signs, they prevent incidents. Keeping in line with all relevant regulations ensures your business is up-to-date and lawful. Compliance management avoids legal action and potential fees, which is even more critical going forward, as specific penalties under the Affordable Care Act (ACA) intend to increase. For instance, the “hammer penalty” cost $240 per employee in 2023, resulting in an annualized total of $2,880.

Compliance management from Viventium Software.

Compare Top Payroll Software Leaders

Primary Benefits

From streamlining your payroll processes to eliminating costly errors, payroll systems have a lot to offer. Check out the other core benefits of using a payroll solution below!

Improve Accuracy

Payroll systems automate payroll processing, increasing efficiency and accuracy. Using a payroll system calculates wages, deductions and taxes, reducing the chances of human errors in manual calculations. Boosting accuracy helps avoid costly mistakes that can lead to legal and financial repercussions.

Save Time

Payroll systems can be a lifesaver, especially come tax season, because failing to file on time can cost businesses hundreds. They automate repetitive tasks like data entry, calculations and tax filings, freeing HR and payroll professionals to focus on other core responsibilities.

Increase Customization

Different businesses have unique payroll needs, so a one-size-fits-all approach is rarely ideal. With that in mind, most payroll systems have customization to meet your specific requirements. Tailor the system to accommodate various pay structures, deductions and benefits.

Enhance Compliance and Reporting

Stay compliant with tax laws and regulations with automatic updates on tax rates and rules, reports for tax filings and audit trails for all payroll. Reporting also helps mitigate the risk by ensuring transparent payroll operations.

Ensure Data Security

Payroll systems provide robust data security measures, protecting sensitive employee information. Most payroll systems have encryption, customizable access controls and regular data backups to safeguard data against unauthorized access. This level of security is challenging to replicate with manual payroll processes or spreadsheets.

Streamline HR Tasks

Integrate with other HR and accounting systems for a streamlined approach to payroll processing. Integrations ensure payroll systems work smoothly with other core tasks, like time and attendance, ultimately saving time and enhancing efficiency.

Compare Top Payroll Software Leaders

The Best Payroll Software Vendors

To earn the title of best payroll software vendor, providers need a user-friendly interface and provide additional payroll and/or HR features that make your job easier.

SelectHub compiles data from reviews and factors in key requirements for payroll systems. With this information and a scoring algorithm, we rate and rank tools to present the best solutions to you.

Paychex

Paychex is a cloud-based solution providing a comprehensive HR and payroll management suite. It is accessible from any device, making it easy for employers and employees to stay on top of their work. Paychex also supports HR tasks like employee development, recruitment and benefits administration for simplifying core HR tasks.

The unified platform includes online payroll processing, tax management, deduction tracking and reporting. It integrates with time and attendance features to automate calculations, tax filing and payments, saving time on federal, state and local tax requirements.

Paychex Payment Dashboard.

Workday HCM

Workday HCM is a SaaS solution that streamlines employee lifecycle management. It offers payroll capabilities for the US, UK, France and Canada, consolidating all transactions within its payroll module.

The calculation engine lets users run reports and perform calculations for groups and individuals. The compliance dashboard gives insights into upcoming changes and streamlines administrative tasks like managing forms. It also offers access to over 3,000 localized data fields, automatic translation into more than 30 languages, free legal support across 58 jurisdictions and complete control over setup configurations.

Workday HCM Report Preview.

Namely

Namely is a cloud-based solution for managing payroll, time and attendance, benefits and other core HR responsibilities. The system manages benefits, talent management (including onboarding, goals and reviews) and payroll. The self-service side of Namely is easy to use and built to increase employee engagement and, by extension, employee productivity.

Namely’s payroll module keeps things simple for your HR team. Keep benefits deductions up-to-date and automatically file payroll taxes. ACA reporting and end-of-year reporting are also automatically generated. Hours worked and integrate employee’s hourly wages easily into the system.

Namely People Profile Preview.

Compare Top Payroll Software Leaders

Next Steps

Most vendors offer nearly identical payroll system features, so feeling lost in the shuffle is easy. Ensuring you find the best payroll system means considering the most beneficial features for your employees. Analyzing the needs of your business will help you find the best payroll system for your organization.

Keep the list above handy during your search. Of course, each business, from small to enterprise, has unique qualifications for their ideal HR software. Once requirements are determined, you can compare vendors with our free comparison report to find the software most fitting for your needs.

Which of the key payroll software features stood out to you the most? What payroll system benefit is most important to you? Let us know in the comments below!